It is perhaps worth taking a bit of time to briefly add a few skeptical thoughts into the mix regarding the GameStop bubble and the inevitable crash.

First a quick primer.

What exactly is going on? The basics

When you buy stock in an organization you are in effect giving them money. They can then use that to grow their business. They use that to do stuff; manufacture, mine, import and sell, etc… Rather obviously their goal is to make money. Because you invested, you also expect to be rewarded financially.

Obviously people come and go, and so naturally the concept of buying and selling stock is a thing. As a business does well, the value of the stock will rise. If however the business is not doing so well, then the value will drop. What drives this is demand. If a company is doing well, for example Apple, then the demand for their stock is quite large so the price is high. If however the business is not doing well, the lack of demand for the stock will result in it falling.

Now let’s talk about what is known as shorting?

What exactly is shorting?

What some hedge funds do to make money is to keep an eye out for a business that is on the way out. GameStop is a good example. Their bricks and mortar (chain of high street shops) were once a very good business. Open a store, sell games at a good profit and make money. Lots of people love games, so they once did very well. Times have changed. We are rapidly moving away from going to a store to buy the latest hot game. You download instead or simply stream online.Why buy an expensive console when you can instead log into a game in the cloud and then play against lots of others on that platform.

The GameStop balance sheet reflects this new reality. Clearly 2020 was indeed a bad year for them.

| ITEMITEM | 2016 | 2017 | 2018 | 2019 | 2020 | 5-YEAR TREND |

|---|---|---|---|---|---|---|

| Sales/RevenueSales/Revenue | 9.36B | 8.61B | 8.55B | 8.29B | 6.47B | |

| Sales GrowthSales Growth | – | -8.07% | -0.71% | -3.06% | -21.96% |

Those that understand their business model can see this. The long-term trend is obvious.

It is not (if you will forgive the pun) game over. They might evolve and adapt; toss the bricks and mortar stores and go online to meet the demand there. A good example of that is Netflix. They evolved from delivering DVDs through your door to a model where you stream content. It’s complex of course. Netflix took on lots of debt and used the money to make lots of original content. Some were dubious about this, but the bet appears to be paying off. They now have 200 million subscribers and are global. They still have lots of debt. You might expect the Netflix stock to soar because everybody loves netflix and wants lots of it. That pile of debt is a huge concern to those that dig into their business model, so the stock price reflects that degree of wholly appropriate concern.

Anyway, back to GameStop and shorting.

When a big hedge fund spots a failing business in a downward trend they can leverage that

- Without having any of the stock, they borrow the stock, and sell it at the current price

- Then … later … they buy the stock they sold at a lower price because it is inevitably falling.

- Once they go short, sell before they own it, they are in effect taking a risk. They have to balance it all at some point and return what they borrowed and then sold.

- There are rules, there is a mandated limit to the amount of time you can go short for. Traders are forced to buy to balance things out.

- Basically they spot the trend, sell (let’s say at $10), then later buy at $5 and so make a profit.

- The risks are vast – if that $10 later rises to say $20, the investor who went short must buy at $20 – net result is huge losses

Bottom line: going short can bring big rewards, but can also not simply wipe out your investment, it can also cause you vast financial losses beyond your initial one.

Guidance: If you don’t know what you are doing, and do not truly understand the fundamentals, then don’t. Seriously, just don’t.

So what is up with GameStop?

It was in a downward trend, so the hedge funds were going short on it. A community of small investors on Reddit noticed this and decided to basically stick it to the hedge funds, so they collaborated, leveraged the power of the internet and embarked upon a campaign of buy buy buy GameStop. Net effect is that there has been a massive increase in demand for the stock. That has been driving the price up.

The hedge funds who went short can see this and realise they are on track for massive losses – billions $$ – enough to completely bankrupt them, so they in turn scramble to close their short positions as fast as possible. Net effect even more demand for GameStop and so that drives the price even higher.

Meanwhile, other small investors spot a rising trend, and jump in with the hope of making a quick buck, and so even more demand drives the price even higher.

Now hit pause for a moment.

None of this reflects the true value of the actual business. We have a bubble. What is inevitable is that at some point this bubble will burst and the GameStop price will crash. This will wipe out many small investors.

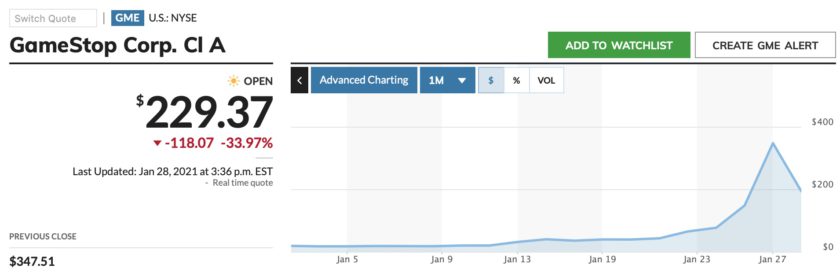

Here is what has happened to the GameStop stock price over the last month – basically it has been a rather dramatic week – …

In other words, a stock that has been trading for roughly $10 is suddenly trading for rather a lot more and that has most probably bankrupted those big hedge funds who went short on it.

Robinhood

As a side show, one of the stock trading platforms is called Robinhood. They have seen a huge demand that is simply not warranted by the underlying business model, so they and other similar platforms stopped all trading for GameStop.

They know that those buying now will be wiped out. They are striving to protect people who are way too stupid to understand what is about to happen to them.

Many are crying foul and claiming that the big corporations are stopping them from making money.

(OK, that’s just a brief summary that is a tad simplistic, but you get the general idea. Emotions are in full flight).

Meanwhile other entities, also called RobinHood, are seeing a huge increase in demand. For example the RobinHood society that does not trade stock, but simply sells stuff related to the Robin Hood myth, have … well you can see for yourself …

Yes indeed, some have been mixing up the RobinHood stock trading platform with the actual Robin Hood society based in Nottingham, UK.

The most common commodity being actively traded here is stupidity. Then again you most probably already knew this because you have observed vast numbers of people vote for Trump, IQ45.

The fact that 400,000 are dead was an insufficient warning that four more years of the same might not be such a great idea is truly jaw-dropping. History will not be kind to his supporters.

Is the GameStop bubble a Unique event?

Humans often go collectively crazy and so the demand for something drives the price far beyond what it is actually worth. The word we have for that is greed.

Is this unique?

Nope, it is a pattern that repeats over the centuries.

- Tulipmania gripped Holland in the 1630s – During the Dutch Tulip Bubble, tulip prices soared twentyfold between November 1636 and February 1637 before plunging 99% by May 1637. At its peak, some tulip bulbs commanded prices greater than the price of some houses

- The South Sea Bubble of 1720 – The South Sea Company was formed in 1711 and was promised a monopoly by the British government on all trade. As its directors circulated tall tales of unimaginable riches in the South Seas (present-day South America), shares of the company surged more than eightfold in 1720, from £128 in January to £1050 in June, before collapsing in subsequent months and causing a severe economic crisis.

- Japan’s economic bubble of the 1980s – Japanese stocks and urban land values tripling between 1985 and 1989. Why? Because the government had ushered in a program of monetary and fiscal stimulus. The bubble burst in 1991, setting the stage for Japan’s subsequent years of price deflation and stagnant economic growth. At the peak of the real estate bubble in 1989, the value of the Imperial Palace grounds in Tokyo was greater than that of real estate in the entire state of California.

- The Dotcom Bubble – The increasing popularity of the Internet triggered a massive wave of speculation in “new economy” businesses. As a result, hundreds of dotcom companies achieved multi-billion dollar valuations as soon as they went public. Problem was that many of them did not have a credible business model, hence an inevitable crash

The one thing all bubbles have in common is the pure stupidity of it all. People suspend disbelief and jump into the frenzy in the hope of making a fortune.

The bigger the bubble is, the greater the degree of pain that follows when the inevitable crash happens.

There is a Guaranteed way to make a small fortune in the stock market

One last note of caution.

There is a rock solid way of making a small fortune in the stock market.

Seriously, there really is.

Do this.

Start with a large fortune and buy GameStop today. Your large fortune will soon be a small fortune.

I guarantee it.

Thanks for yet another great and fun story. I notice you did not mention bitcoin as a bubble. Not talking about the blockchain technology itself but specifically bitcoin. Just today “Bitcoin leapt 17% to $37,627 on Friday after billionaire Elon Musk updated his Twitter bio to “#bitcoin.” BI. If this is not the sign of a bubble speculation, I wonder what is, knowing that bitcoin has no other use for the public than trading (outside paying ransomware). At least a tulip bulb will give birth to a beautiful flower.

Is there a reason for not mentionning bitcoin in your article ? More globally, shouldn’t we be skeptical about bitcoin ? I did not find a article in your site.

Thanks again.

Thanks for the thoughts Pierre, much appreciated. The idea of a separate posting on Bitcoin is a good suggestion, I’ll add it to my list.